This LBO exercise was completed as a final group project for Entrepreneurial Finance and Private Equity (BUSN 34101) at Chicago Booth.

The deal memo can be found here, financial model here, and presentation here.

This report utilizes the OUTSIDE-IMPACTS (+ CUPID) framework for evaluating a business, developed by Professor Steve Kaplan and taught by Professor Scott Meadow.

14 August 2024

Bumble Inc. (Nasdaq: BMBL)

Note: In this report, “Bumble” refers to the individual Bumble app, whereas “Bumble Inc.” refers to the company inclusive of the entire app portfolio. Chicago Booth Ventures (“CBV”) is the fictitious investment firm that is evaluating this potential deal.

Background

Stage / Opportunity

Bumble Inc. has been growing adjusted EBITDA at a stead clip, from $143.1 million in 2020 (just before its IPO) to $275.6 million in 2023, representing a 24.4% compound annual growth rate (CAGR). However, the company has struggled to continue its revenues in recent quarters and given the risks associated with such a competitive industry, we deem a hurdle rate of 25% appropriate for Bumble Inc.’s LBO.

Business Description

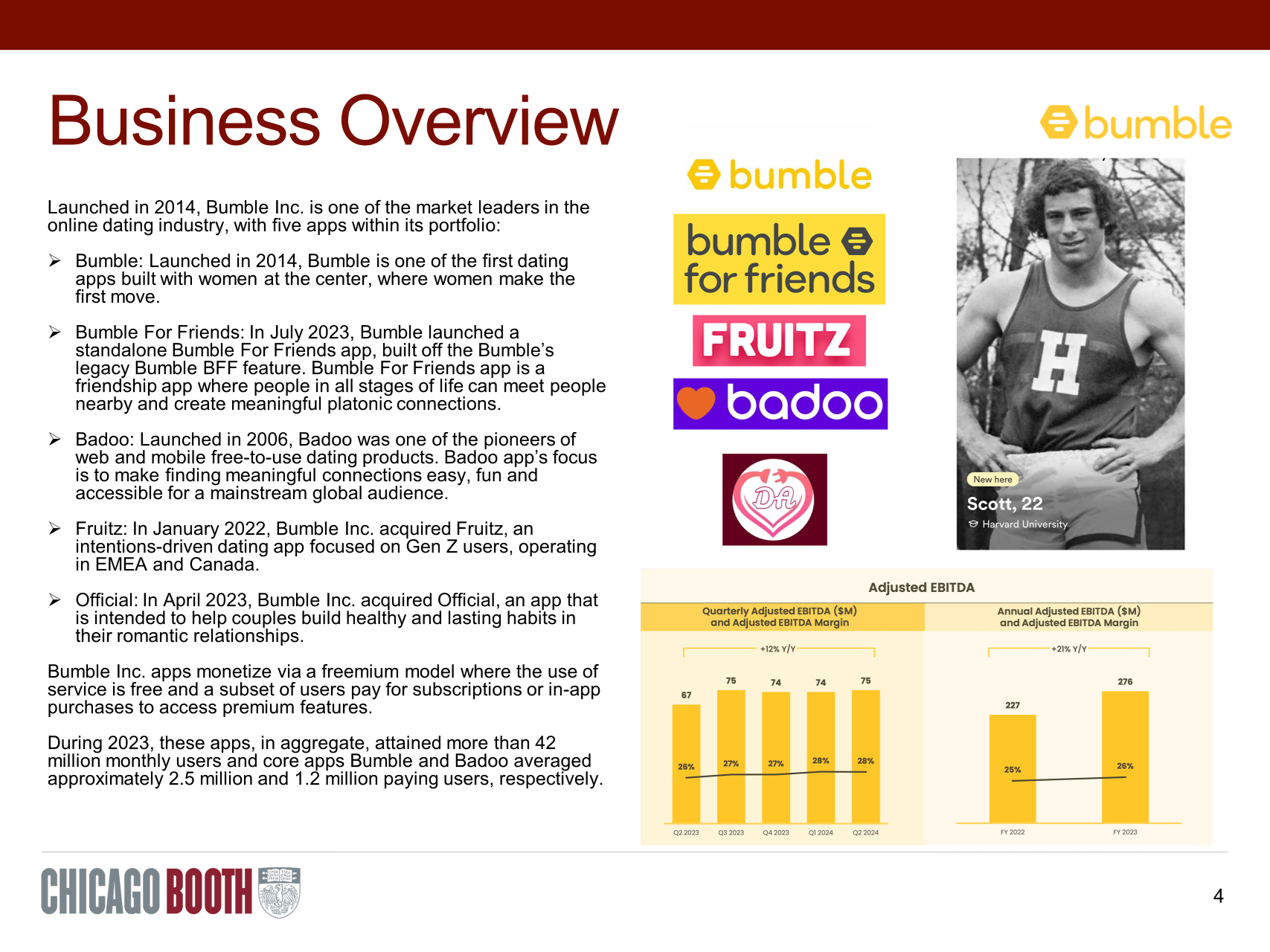

Launched in 2014, Bumble Inc. is one of the market leaders in the online dating industry, with five apps within its portfolio: Bumble, Bumble For Friends, Badoo, Fruitz, and Official. During 2023, these apps, in aggregate, attained more than 42 million monthly users and core apps Bumble and Badoo averaged approximately 2.5 million and 1.2 million paying users, respectively [1].

Macro Industry Structure

The advent of several popular dating apps in the late 2000s and early 2010s has catapulted the online dating market into a multibillion dollar industry. In 2024, the global online dating market is expected to reach $3.2 billion and grow at a 2.5% CAGR over the next 5 years, to $3.6 billion in 2029 [2]. This contemplates the number of users growing to 470 million during that time [2].

Much has changed since 1965 when Harvard students created a matchmaking service using an early IBM computer. Online dating took off in the 1990s and into the 2000s, and dating apps joined shortly thereafter. Leading dating app Tinder was launched in 2012 and brought the subsegment of dating apps even further into the mainstream, changing how young adults date with an addictive “swipe left, swipe right” format for users to designate interest in a potential partner. Five years later, Match Group converted its options that valued the company at around $3 billion [3].

By the late 2010s, online dating became the second-most popular way for couples to meet [4]. By 2019, in a survey of U.S. adults, 30% of all respondents - and 53% of respondents under age 30 - said they had used a dating site or app, statistics which held up when the study was repeated in 2022 [5]. Interest in dating sites and apps also tended to over-index with those living in urban areas as well as those in the LGBTQ community [5].

[4]

Further fueling the rise of dating apps has been their ability to hold users for extended periods of time, similar to social media. In fact, in 2018 research studies commissioned by Badoo showed that millennials were spending a surprising 10 hours a week on dating apps [6].

The industry is heavily concentrated with the four largest players - led by Match and eHarmony - accounting for nearly two-thirds of all revenue [7]. Within these companies are several brands themselves. The Apple App Store in the U.S. includes apps in their “Best Dating Apps” list such as Bumble, Badoo (owned by Bumble), Tinder (Match), Hinge (Match), OkCupid (Match), Plenty of Fish (Match), and eHarmony [8]. In such a competitive market, dating apps tend to stake out a subsegment demographic (sexual orientation, religion) or use occasion (casual relationships, marriage seeking) [9]. Refer to CNET’s “Best Dating Apps for 2024” list, which outlines these well.

[9]

From a revenue-generating perspective, nearly 80% of dating apps use a freemium model, in which basic features are offered for free and premium features are available [10]. Basic features typically include the ability to create an individual profile that potential partners can “like” or swipe left or right on to indicate interest. Non-paying users often face more limited likes or swipes available to use, lower profile visibility, a lack of filtering options, and in-app advertising. Premium features are typically available via monthly (or annual) subscriptions that average roughly $15 per month, though there is much variation in the market [10].

OUTSIDE

(O) Opportunity

The opportunity related to Bumble Inc.’s business centers on growth opportunities in five primary areas, which are highlighted below.

Growth within exiting markets: Bumble is a leading dating app in several countries including the U.S., U.K., Australia, and Canada. Meanwhile, Badoo is a leader in Europe and the U.K. To grow both apps in their respective markets, the company seeks to increase brand building and marketing investments (particularly for Badoo) as well as product innovation [12].

Growth within new markets: In 2023, approximately 43% of Bumble Inc.’s revenue derived outside of North America, which is also where untapped markets exist for the company [12]. The company sees large opportunities in Western Europe–a region the company entered in 2021, particularly Germany, Spain and France–Asia, and Latin America (notably Mexico), where it can leverage its existing app insights and run similar playbooks for growth initiatives [19, 20].

Investment in innovation: Bumble Inc. was at the forefront of technology trends a decade ago as it entered the dating app industry. Now it looks to be an innovator in dating and connection-related technology by utilizing machine learning and data science to drive more successful outcomes for users which, in turn, will attract incremental users to its platforms [12].

Increasing monetization: Operating under the aforementioned freemium model, the company is working on increasing monetization initiatives by improving features available in its subscription programs. It has also explored various pricing strategies that have been tested over the years [12]. While average revenue per pay user for Bumble decreased to $25.79 (down 9% year-over-year) in the second quarter of 2024, the number of paying users increased to 2.817 million (up 15% year-over-year) [14].

Expanding into new categories beyond dating: Although Bumble Inc. was built on the dating app industry, it has since waded into adjacent categories. Examples of this include platonic friendships-focused Bumble BFF and business networking-focused Bumble Bizz [12]. This focus has been exemplified through recent decisions such as the May 2024 acquisition of Geneva, which we detail subsequently in this memo [13]. We believe Bumble Inc. can and will remain active in the M&A space.

(U) Uncertainty

There are a number of uncertainties that could materially impact Bumble Inc.’s business operations. We detail these below:

Low Switching Costs: The dating app industry is highly competitive and switching costs are low. Many dating apps, including those within Bumble Inc., utilize a freemium model, making the ability for a user to switch to another app nearly seamless. Even users subscribing to the one of Bumble Inc.’s current services would typically only have to wait until the end of a billing period before switching platforms (or could opt to temporarily pay for multiple subscriptions simultaneously). We view this as a factor that will need to be monitored on an ongoing basis as long as formidable competitors remain in the market.

Changes in the Dating Environment & Trends: As previously mentioned above, the dating service industry has vastly changed over the past decades, with the most recent involving the shift from online / web-based dating to dating apps. Other trends have been more temporary, such as the outsized growth the industry saw early in the Covid-19 pandemic, which somewhat waned as consumer mobility improved. We deem this uncertainty to be of more moderate risk currently.

Quality Reduction in User Base: Bumble Inc. can only perform as strong as both the quantity and quality of its user base. From a quantity standpoint, losing a portion of users can have a “leveraged” effect as users may deem the remaining user pool as less intriguing. From a quality standpoint, Bumble Inc. (and its competitors) face the challenge of mitigating spam bots and AI-generated accounts. In fact, the company launched a new feature on the Bumble app in July 2024 to allow users to report profiles that they believe use AI-generated photos or videos [17]. We deem this to be an ongoing threat of moderate risk.

Brand Sentiment & Impairment: Bumble Inc. markets itself as a mission-based, female-founded company. Negative publicity or other external factors and events (such as, hypothetically, a cyber attack and leak of users’ private information) could cause irreparable damage to the company’s branding. We believe this is a high risk.

(T) Team

The Bumble Inc. management team consists of individuals with proven track records in the technology and communications platform spaces. CEO Lidiane Jones took over as CEO in January 2024 and there have been several new additions and promotions to management.

Whitney Wolfe Herd (Founder & Executive Chair): Executive Chair since January 2024. Founded Bumble in 2014 and served as CEO from 2020-2024. Previously was a co-founder of Bumble competitor Tinder where she was Vice President of Marketing from 2012 to 2014. B.A. in international studies from Southern Methodist University [11].

Lidiane Jones (CEO): CEO since January 2024. More than 25 years of product development experience. Previously was CEO at Slack Technologies where she led the integration after its acquisition by Salesforce. Jones came directly from Salesforce itself, where she held various Executive Vice President roles. In addition, Jones served as Vice President of Software Product Management at Sonos, overseeing the delivery of the Sonos experience layer and platform from 2015-2019. Early on, she spent nearly 13 years at Microsoft in various Product Manager and Group Product Manager roles. B.S. in computer science from the University of Michigan [11].

Anu Subramanian (CFO): CFO since September 2020. Previously CFO, Digital at Univision Communications Inc. from 2018-2020 as well as CFO, Digital at VICE Media during 2017. Additionally, Subramanian served in several roles at Scripps Networks Interactive, ultimately spending three years as CFO Digital there from 2014-2017. Early career highlights include time in Citi’s Media Investment Banking and EY’s Assurance groups. BCom from Delhi University and MBA from the Yale School of Management [11].

David Ard (Chief People Officer): CPO since February 2014 where he is responsible for Bumble Inc.’s people strategies, workplace culture, talent acquisition and development, and employee wellbeing. Previously Senior Vice President of Employee Success at Salesforce, where he led the people strategy and teams at Slack (and overlapped with Jones). Before Slack, he served as CPO at Equinox from 2019-2022 and held various roles at Gap from 2004-2009, ultimately serving as Senior Vice President and Global Head of People & Culture and Communications. B.A. in Organizational Communication from the University of Central Florida [11].

We note that founder and previous CEO Whitney Wolfe Herd had sector-specific experience due to her past time at Tinder, which has now changed as Jones became CEO earlier this year. However, we believe Jones’s background in the technology and communications spaces is a positive for the company. We also highlight that several management team members have past professional experience with each other, including the aforementioned time at Slack between Jones and Ard as well as with Chief Product Officer Ali Rayl. Additionally, Subramanian worked together with Chief Technology Officer Antoine Leblond while at Sonos [11].

We believe the management team is well-suited to guide Bumble Inc. in the right direction moving forward. Post-buyout, we do believe that an external hire with a background in social media (outside of Chief Marketing Officer Selby Drummond, who was previously at Snapchat) could be beneficial to develop strategies around “socializing” the Bumble brand [11]. One candidate we believe is worth pursuing is Kate Orseth, Director of Product Management at Meta. In Orseth’s current role, she is focused on supporting dating, events, and gaming initiatives on Facebook and has been with the company since 2014. Orseth also has past experience as an Engagement Manager at McKinsey & Company from 2011-2014.

(S) Strategy and Required IRR

We believe Bumble’s strategy revolves around four main ideas, in addition to the top-line initiatives discussed in the Opportunities section above.

Active M&A Player: The company should implement an acquisition strategy to further penetrate the social relationship market in existing and new geographies. We have identified multiple potential acquisition targets including Coffee Meets Bagel, Feeld, Raya, and Muzz, which will enhance Bumble’s products and increase market penetration.

Cost Prioritization and Reallocation: Management should reallocate sales and marketing spend towards recovering previous users in existing markets, potentially through a rebranding strategy, and under penetrated international markets.

Cost Reduction: Bumble Inc. can reduce costs in multiple identified areas including reducing global workforce by approximately 350 roles and stripping out existing public company operations.

Leading on Artificial Intelligence: There is low-hanging fruit when it comes to implementing new AI capabilities onto the platforms including an AI-assisted photo picker to ease the profile creation process. Additionally, AI may be implemented to provide conversation support for our customers and reduce existing support costs.

Considering the above and Bumble Inc.’s history of relatively strong cash flows, we do note that the company has experienced recent turmoil. As such, we believe there are opportunities to grow and expand their business via acquisition and international expansion, and thus is best represented as a growth platform. Consequently, an IRR of 25% will be required.

(I) Investment

CBV proposes to acquire Bumble Inc. with an aggregate transaction value of $2.03 billion. The financing for the acquisition will be strategically structured through a blend of debt and equity.

Senior Term Loan: $770 million with an interest rate of 9.08%. The rate is given by SOFR + 375 bps.

2nd Lien Term Loan: $289 million with an interest rate of 12.83%. The rate is given by SOFR + 750 bps.

Mezzanine: $96.2 million with an interest rate of 12%, no PIK, and no Warrants.

Rollover Equity from Blackstone: $332 million based on the takeout price. If Blackstone does not agree to roll over their equity, an additional equity investor should be sought due to the size of the equity required.

Management Equity: Assume management will contribute 5% of the total equity ($43.9 million) in exchange for ownership in the pre-diluted shares in addition to 5% of the diluted shares in the form of performance options.

CBV Equity: $440.4 million equity investment.

Total equity investment is $816.2 million

Total debt financing is $1.2 billion

Excess cash from Bumble Inc.is $61.7 million (based on pro forma cash balance and historical cash balances as a percent of total assets.

(D) Deal

At closing, CBV will hold 51.27% of the fully diluted equity (which includes options set aside for management). Management will hold 10.11% of the fully diluted equity. Blackstone will retain a 38.62% non-controlling fully diluted stake.

The acquisition will be financed through a combined $1.2 billion in senior debt, 2nd lien senior debt, and mezzanine debt.

The management of Bumble Inc. will be incentivized to deliver strong performance through equity ownership in the company.

(E) Exit

After the take-private transaction, it will be highly unlikely for Bumble to IPO again. If the Company is able to successfully implement the ideas set forth in the “Investment Thesis” section, we believe a number of acquirers could be interested. These include strategic buyers, such as IAC (a media and internet conglomerate that owns significant stakes in companies such as Match Group, Angi, Care.com, and Vimeo) as well as private equity firms such as The Blackstone Gr`oup, Vista Equity Group, and Francisco Partners, all of whom have been active in the dating app space in recent years and have purchased high growth companies.

IMPACTS

(I) Idea / Industry

Bumble Inc. focuses on creating “kind connections” through its platform of apps including the eponymous Bumble app, Bumble For Friends, Badoo, Fruitz, and Official. “We observed that women were often treated unequally in society, especially in romantic relationships,” Bumble Inc. stated at the time of its IPO in 2021. “At the same time, social networks created possibilities for connections, but they were focused on connections with people you already know and lacked guardrails to encourage better behavior online” [12].

As of the second quarter of 2024, the company has 4.1 million paying users, of which roughly 70% are on the Bumble app. In addition, North America (U.S. & Canada) accounts for just over half of company revenues each quarter [24].

Value can be extracted from Bumble Inc.’s via its growth strategy that centers on five main initiatives: 1) growing existing markets; 2) growing in new markets; 3) investing in innovation; 4) increasing monetization; 5) expanding into adjacent categories [14]. While the company appears to be facing headwinds with softness in consumer spending and softness, as detailed in their second quarter earnings release, we view these as more transitory in nature.

Bumble Inc. competes in a highly competitive industry, where users have low switching costs and several competitors own portfolios of multiple dating apps (most notably Match Group). The company seeks to differentiate itself through the aforementioned focus on healthier relationships and connections as well as “women-focused” initiatives.

As detailed in the Team section above, Bumble Inc. recently installed a new senior management team and turnaround efforts are underway, though it is early to make any judgments.

(M) Market / Valuation

Management estimates that the total addressable market (TAM) of single users in the world is 2 billion [20]. Meanwhile, the number of users currently using online dating services is a (relatively) measly 381 million [21].

As mentioned throughout this memo, there is an opportunity beyond dating. Some of Bumble Inc.’s lesser known apps or features such as Bumble for Friends and Bumble Bizz help expand that TAM and bring in more long-term users (unlike those looking for relationships, who might stop using the app once successful).

While Tinder is the leading player in the U.S. dating app market, Bumble has the No. 2 share. Further, Badoo–which has a minimal presence in the U.S.–is the most downloaded dating app in the world with over 400 million registered users [22].

(P) Present Value

Bumble Inc.’s TAM of 2 billion users and its current base of 4.1 million paying users is impressive [14, 20]. The company has established itself with a positive brand image with its progressive “women make the first move” goal in every app interaction. The user bases of both Bumble and Badoo are incredibly strong, and there are opportunities for both to expand into other untapped geographic markets. There is also value in the incremental business that can be attained from more connection-based services like Bumble for Friends and Bumble Bizz, as well as future acquisition targets that could integrate and complement the existing business well. The fresh management team should also be a positive for the company and, coupled with recent rebranding, we believe there is an intriguing opportunity and value in the long-term.

(A) Acceptance

Bumble Inc. provides a connection service through dating apps and more recent adjacent areas such as friendships / platonic relationships and business networking. The acceptance of its platforms can be exemplified by its rapidly increasing revenue, which grew at a 21.8% CAGR from 2020 (just prior to the IPO) to 2023.

We believe that users’ first priority is the ongoing success of finding connections, romantic or otherwise, on the company’s apps and there should be widespread user acceptance as long as that continues. The company has been consistent in its messaging for years, as reiterated by Drummond in April when Bumble Inc. launched in-house rebranding. “Our core principle remains the same,” Drummond said. “Empowering women in every connection and in every relationship” [18]. As a result, a potential buyout should be viewed positively (at best) or indifferently (at worst) by customers.

(C) Competition

As discussed in the Uncertainties section, there are low switching costs in the industry. Consequently, competition is fierce, and we deem brand equity as somewhat fragile.

We consider the closest and most comparable competitors as the following (listed alphabetically): Coffee Meets Bagel, eHarmony, Hinge, The League, Match, OkCupid, Plenty of Fish, and Tinder. Other demographic-focused dating apps (based on sexual orientation, religion, etc.) also pose a threat. To stand out against other dating apps, continued brand building investments will be crucial as well as competitive pricing for premium services.

Separately, we believe social media or other platforms with already developed user bases could represent a potential competitive threat in the long-term. For example in 2018, Facebook began testing the Facebook Dating feature–offered within the flagship Facebook app–in select countries, with wider rollouts in phases during 2019 and 2020 [23]. While the feature has not developed into a material competitor in the space, we believe conceptually that this type of incremental feature to an already popular platform could be a threat in the future. Furthermore, a platform such as Facebook offers plenty of connection-based features (beyond “Facebook friends”) such as Facebook Groups, which achieve some of the same components as Bumble for Friends and Bumble Bizz.

(T) Timing

The timing for a transaction is relatively favorable as the stock has significantly underperformed the S&P 500 since its IPO in February 2021. In fact, the stock is down nearly 60% year-to-date in 2024, which includes a drastic fall following its second quarter earnings release on August 7, 2024. Now that the initial reaction has occurred, we believe the stock price should be relatively stable in the short-term.

In the past year, there has only been minor media coverage relating to strategic buyers or private equity funds being potentially interested in a take-private deal of Bumble Inc. Public reports have speculated that after sitting on the sidelines for much of the past couple years, strategic buyers could be more interested in underperforming tech stocks that had lofty valuations at the time of their IPOs in 2020 and 2021, criteria that would match Bumble Inc.’s situation [16].

(S) Speed

Bumble Inc. was on the early end of identifying trends in the online dating space in the early 2010s and has been rewarded with one of the higher market shares as a result. More specifically, Tinder has the leading share in the U.S. with 29%, and Bumble sits in second with 26% [15].

We believe Bumble Inc. must remain active in the M&A space to find opportunities to grow its brand and integrate features that complement its dating capabilities.

CUPID

(C) Competition

As outlined in the Macro Industry section, there are several direct, app-based competitors to Bumble including Tinder, Hinge, and Coffee Meets Bagel. Each brings unique features and approaches to online dating, but Bumble’s focus on women empowerment (i.e., only women can initiate conversations), seeking to promote values of respect and equality is differentiated. Unlike its competitors, Bumble also offers additional modes for friendship (Bumble BFF) and business networking (Bumble Bizz). This does not mean other players cannot expand into other product lines as well, and switching costs are extremely low. However, there could be a level of user-stickiness once an individual is on a specific platform because each app caters to varying preferences and relationship goals allowing the user to choose the app that best fits their dating style.

(U) Unique

CBV does not have prior experience investing in dating/relationship apps. However, it has experience with software companies and may be able to provide leads for rounding out the C-suite.

(P) Price

The aggregate transaction value of this transaction is $2.03 billion. This purchase price falls between our floor and ceiling prices calculated using various valuation methodologies (APV, Probability Adjusted APV, Blended Rate, and Comps). The purchase price, however, is closer to the ceiling than the floor.

(I) Improvements

Product Expansion: The primary driver of revenue comes from Bumble’s dating platform. Over the years, it has expanded into additional areas of growth, including business networking and finding friends. Bumble can continue on this trajectory of expanding into other nodes and demographics, such as having a dedicated platform for moms (e.g., stay-at-home moms or working moms).

Bumble could also explore further segmenting its customer base to better cater to their needs and charging a premium for it (e.g., for individuals with income over a certain threshold and are paired with a more hands-on matchmaker throughout the process).

Cross Selling: Once an individual comes onto the Bumble platform, they could be retained by catering to their different relationship needs over time. For example, once a couple is matched on Bumble and get married, they could also expand into Bumble’s parenthood platform (whether that’s for new parents, parents of older kids, teenagers, and potentially even empty nesters).

Follow-on Acquisitions: Acquisitions of smaller players could help Bumble continue to scale and acquire new customers at lower cost.

(D) Distress

Low Barriers to Entry and High Competition: The barriers to entry for developing a dating/relationship app are low in terms of the initial financial and technical requirements, and the market itself is highly crowded. For both existing and new players, user acquisition costs can be high (e.g., digital ads, influencer partnerships, and campaigns require significant investment upfront). In addition, dating apps rely heavily on the network effect as users are more likely to join a platform that already has a large user base.

User Retention May be Challenging: Dating apps can have churn rates as users fail to find a match, get frustrated, and abandon the app. Platforms need to be continually evolving, introducing new features and improving user experiences. Additionally, companies need to focus on the right monetization strategy (e.g., in-app purchases vs subscription), which can impact user acquisition and retention.

MORE

Investment (Dollars Invested)

$2.03 billion aggregate transaction value.

$440.4 million from CBV

$331.8 million roll over from Blackstone.

$43.9 million from current Bumble management

$61.7 million of excess cash

$769.8 million in Senior Debt

$288.7 million in 2nd Lien Senior Debt

$96.2 million in Mezzanine Debt

Unit Model (Smallest Unit of Investment to Test Business Thesis)

Proof of concept has already occurred and Bumble Inc. has established itself as one of the industry leaders in online dating. The continued growth story will depend on management’s ability to execute on strategic initiatives including possible M&A, cost reductions, and international expansion.

Financing (Description, Securities purchased)

The transaction will be funded by a combination of a Senior Term Loan ($770 million), a 2nd Lien Term Loan ($289 million), Mezzanine Debt ($96.2 million), rollover equity from Blackstone ($332 million), management equity ($43.9 million), and CBV equity ($440 million).

Assuming Blackstone agrees to our plan, their equity would be replaced with common shares at the proposed transaction buyout price. After dilutive effects, their investment would represent 38.62% of the fully diluted shares.

CBV’s investment will buy common equity shares which upon accounting for all dilutive effects will represent 51.27% of the fully diluted equity.

Financials

Company case: For the full year ended 12/31/24, Bumble Inc. is guiding towards year over year revenue growth of 1-2% and EBITDA margin growth of at least 200 basis points.

Partnership Case:

Consensus analyst forecasts were sourced from Capital IQ and used for forecasting initial years for Revenue, Gross Margin (and subsequently COGS), and EBIT (and subsequently SG&A). Adjustments were made based on management guidance related to staffing cuts and other strategic initiatives. Most notably, General & Administrative costs were reduced by ~33% as a % of revenue due to these announced initiatives.

The financing plan assumes the current noncontrolling interest party, Blackstone, will roll their current equity position into the new company at the take out price. If Blackstone refuses to roll over their equity, an additional investor would be required in order to deliver required rates of return for CBV.

A minimum cash balance requirement was determined based on Bumble Inc.’s historical cash holdings as a percent of total assets. Free Cash flows must first be used to maintain this minimum cash balance prior to paying down debt. In Bumble Inc.’s case, they have an excess of cash beyond this minimum threshold, thus the excess cash will be used in the transaction. In subsequent years, Bumble Inc. is able to generate sufficient cash to begin paying down debt starting with the Senior Debt then moving on to the 2nd Lien Senior Debt. The terms of the Mezzanine Debt require it to not be paid down until the project is exited, thus additional cash will flow to the balance sheet and be utilized to fund operations, M&A deals, or provide a dividend to equity holders, at the board’s discretion.

Key Areas of Concern

Income Statement: CBV projected financials forecast EBITDA expansion over the hold period. For this EBITDA expansion to occur, Bumble Inc. will need to successfully execute identified cost savings plans.

Based on recent guidance by management and macro trends, projected and sustained revenue growth over the long-term may be a challenge.

Days Payable Outstanding is on the low side. The company could potentially extend this metric through negotiations with vendors to allow for cash management improvements.

Returns

Positives

The successful launch and expansion into other platforms, such as BFF and Bumble Biz gives the Company a first mover advantage in those areas compared to other comparable dating apps. These new product lines give Bumble an ability to cross-sell (e.g., users come to find significant others but stay for the relationships, whether professional or personal). Additionally, there are still a significant number of smaller players that would be attractive acquisition targets in a series of roll-up transactions. This could create synergies through consolidation of IT systems, HR systems, finance systems, as well as increase revenue through new customers.

Risks / Issues

Weaker Consumer Spending: Management has commented in recent quarters that there is some weakness at the “top of the funnel” and specifically younger users that are being more cautious about spending. These users are reducing spending in areas such as dating apps [20]. While we believe this is transitory in nature, it is something to monitor going forward.

Other Issues

Upcoming Acquisition: In May 2024, Bumble Inc. announced the acquisition of Geneva, a group and community app for users to connect Based on shared interests. While few details are available as the acquisition is not expected to close until sometime during the third quarter of 2024, we understand Bumble Inc. plans to integrate Geneva into the Bumble For Friends app and focus on greeting greater one-on-one connections, groups, and communities. As a result, we view this acquisition as a positive step for the company to accomplish its strategic goals though, like any acquisition, there could be short-term hurdles and integration costs [13].

Increased Leverage: The transaction will be funded through significant debt, and the increase in leverage can strain the company’s free cash flows.

Regulatory Scrutiny: Take-private transactions are subject to regulatory approval, especially if they involve significant market consolidation (e.g., Match Group owns and operates the largest portfolio of popular online dating services, including Tinder, Match.com, OkCupid, and Hinge among others). Additionally, there has been greater scrutiny in the past several years due to concerns over market consolidation, data privacy, and consumer protection.

Employee Morale and Firm Culture: Current senior leadership was put in place within the past year. A change in ownership and uncertainty about the future could negatively impact employee morale and lead to increased turnover.

Term Sheet Highlights

We note that CBV is buying 51.27% of the business for approximately $440 million. The management will participate in the equity and there will be an option pool set aside for use in attracting new members of the management team as well as performance based purposes based on key financial metrics and returns achieved by CBV’s investment.

The board of directors will consist of five members, one being the current Bumble Inc. CEO, Ms. Jones, two being representatives from CBV, and two outside directors to be determined at a later date.

Recommendation(s)

CBV recommends a bid to take Bumble Inc. private for a total purchase price of $2.03 billion, or $7.18 per share which represents a 20% premium on the closing price on August 9, 2024.

There are numerous opportunities for Bumble Inc. to grow value. Current management and CBV have identified numerous strategic initiatives to reduce costs. Additionally, there are multiple attractive M&A targets that can help Bumble Inc. further diversify its offerings and grow its user base to new demographics, geographies, and special interests.

Bumble Inc. recently brought on numerous new members of the management team. This new team is strong with highly relevant experience and will bring new energy to the Bumble ecosystem to help the company deliver upon the operating and financial targets.

Bumble Inc’s apps are well positioned in the marketplace with Bumble in a strong #2 position overall and the app deemed best for women. Additionally, Badoo is the most downloaded dating app. These strong positions give Bumble Inc. an attractive position in the market which can support growth and value creation through geographic and market expansion. Additionally, its position in the market provides for an attractive parent company for potential M&A transactions.

Finally, there are numerous exit opportunities with strategic buyers (e.g., IAC, Meta, Match Group) or another private equity firm (e.g., Vista Equity Group, Francisco Partners).

If existing shareholders reject the take-out bid at $7.18, CBV could offer up to $8.00. After $8.00 per share the IRR no longer exceeds the required hurdle rate.

References

[1] Bumble Inc. Form 10-K For the fiscal year ended December 31, 2023. (2024, February 28). EDGAR. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001830043/000095017024022104/bmbl-20231231.htm

[2] Online Dating - Worldwide. Statista. https://www.statista.com/outlook/emo/dating-services/online-dating/worldwide

[3] Tinder Hits $3 Billion Valuation After Match Group Converts Options. (2017, August 31). Forbes. https://www.forbes.com/sites/stevenbertoni/2017/08/31/tinder-hits-3-billion-valuation-after-match-group-converts-options/

[4] Love at First Swipe: The Evolution of Online Dating. (2020, May 28). Stylight. https://www.stylight.com/Magazine/Lifestyle/Love-First-Swipe-Evolution-Online-Dating/

[5] Key findings about online dating in the U.S. (2023, February 2). Pew Research Center. https://www.pewresearch.org/short-reads/2023/02/02/key-findings-about-online-dating-in-the-u-s/

[6] Millennials ‘spend 10 hours a week on dating apps’. (2018, January 23). Independent. https://www.independent.co.uk/life-style/dating-apps-millenials-10-hours-per-week-tinder-bumble-romance-love-a8174006.html

[7] Dating Services in the US. (2024, March). IBIS World.

[8] From the Editors | The Best Dating Apps. Apple App Store. https://apps.apple.com/us/story/id1654973266

[9] Best Dating Apps for 2024. (2024, July 31). CNET. https://www.cnet.com/tech/services-and-software/best-online-dating-apps/

[10] How Do Dating Apps Make Money? (2024, January 29). Nimble App Genie. https://www.nimbleappgenie.com/blogs/how-do-dating-apps-make-money/#

[11] Executive Management. Bumble Investor Relations. https://ir.bumble.com/governance/executive-management/default.aspx

[12] Bumble Inc. Form S-1 Registration Statement. (2021, September 7). EDGAR. https://www.sec.gov/Archives/edgar/data/1830043/000119312521266589/d13690ds1.htm

[13] Bumble Inc. Signs Agreement to Acquire Group and Community App Geneva. (2024, May 20). Bumble. https://ir.bumble.com/news/news-details/2024/Bumble-Inc.-Signs-Agreement-to-Acquire-Group-and-Community-App-Geneva/default.aspx

[14] BMBL 2Q24 Earnings Supplement Presentation. (2024, August 7). Bumble. https://s202.q4cdn.com/372973788/files/doc_financials/2024/q2/BMBL-2Q24-Earnings-Supplement-vFinal.pdf

[15] Bumble Revenue and Usage Statistics 2024. (2024, August). HelpLama. https://helplama.com/bumble-revenue-usage-statistics/#:~:text=Monthly%20active%20users%3A%20Hinge%20has,market%20share%20in%20the%20USA.

[16] Will PE’s Take-Private Trend Continue in the Tech Sector? (2024, January 29). Mergers & Acquisitions. https://www.themiddlemarket.com/feature/will-pes-take-private-trend-continue-in-the-tech-sector

[17] Bumble users can now report profiles that use AI-generated photos. (2024, July 9). TechCrunch. https://techcrunch.com/2024/07/09/bumble-reporting-option-ai-generated-profiles/

[18] Female-first dating app Bumble unveils bold new look and useful new feature. (2024, April 30). Creative Boom. https://www.creativeboom.com/news/female-first-dating-app-bumble-unveils-bold-new-look-and-useful-new-feature/

[19] Bumble Inc. (NASDAQ:BMBL) Q4 2023 Earnings Call Transcript. (2024, February 27). Insider Monkey. https://www.insidermonkey.com/blog/bumble-inc-nasdaqbmbl-q4-2023-earnings-call-transcript-1266486/#q-and-a-session

[20] Bumble Inc. J.P. Morgan Global Technology, Media and Communications Conference Transcript. (2024, May 20). Factset. (Transcript accessed via Factset; not publicly available).

[21] Online dating worldwide - Statistics & Facts. (2024, March 27). Statista. https://www.statista.com/topics/7443/online-dating/#topicOverview

[22] Dating App Revenue and Usage Statistics (2024). (2024, June 25). Business of Apps. https://www.businessofapps.com/data/dating-app-market/

[23] It’s Facebook Official, Dating is Here. (2019, September 5). Meta. https://about.fb.com/news/2019/09/facebook-dating/?utm_source=about.facebook.com&utm_medium=redirect

[24] Bumble Inc. Form 10-8 For the quarterly period year ended June 30, 2024. (2024, August 7). EDGAR. https://www.sec.gov/ix?doc=/Archives/edgar/data/1830043/000095017024093910/bmbl-20240630.htm